4 Costs

Presently, the costs that a digital radio network will cause are not exactly known. Only estimations are available. Vodafone has submitted an offer that is based on the common GSM network but extended with ASCI for 2.3 Billion Euros. (cf. Vodafone031216) Only the final tender that should be started in the end of 2004 can show the real costs.

The technique of the network is not as important for the costs as the requirements and the proper execution in legal and organizational manner are. (cf. GAN02, p. 65) There are mainly four parameters that influence the costs:

- Coverage The more coverage is needed, the more base stations are needed, and the higher the costs will be. The original plan to have the network finished in 2006 with a good coverage in Germany is almost not achievable. Only part solutions are possible.

- Number of Users Estimations of the number of users say that there may be 0.3 up to 1.3 Millions of users. Each user must have a device for his or her work and the base stations must serve the users.

- Functionality Vodafone's solution may be less functional than TETRA's or Tetrapol's but it can be appropriate to modified needs, too.

- Delays If the digital radio network is not available by 2006 as it has been planned, a net present value of 1.32 Billion Euros for the time from 2006 until 2015 will be lost. (cf. Gerpott03, p. 12)

4.1 Cost Estimates

The first estimate was made by the BMI in 2001: 1.12 Billion Euros (2.2 Billions DM) for the network infrastructure, 1.32 Billion Euros (2.6 Billions DM) for 900,000 devices for end users. (cf. BMI010726) Another - less differentiated - estimate says that the digital network will cost 4 up to 6 Billion Euros. (cf. Sachsen, p. 1)

The GAN provided differentiated estimates also including the running costs, but not the costs of base stations, terminals and taxes: 1.5 Billion Euros for the basic network and 1.56 Billion Euros for running costs for ten years. The GAN could not decide whether TETRA or Tetrapol is cheaper. It depends on the markedness of the importance of the following characteristics:

possible advantages of TETRA:

- upgrade costs are lower

- more competition for devices and support means lower costs

- requirements for the connection to the phone network are lower

possible advantages of Tetrapol:

- fewer base stations are needed due to bigger reach

- this causes fewer costs for running and maintenance (cf. Funkschau0401)

Tetrapol for 3.8 Billion Euros However, EADS Telecom has made an offer with costs of 3.8 Billion Euros regarding the requirements of the interest procedure: the building of the network and the operation for ten years.

Use of the existing public Vodafone GSM Network According to GAN the offer made by Vodafone does not fulfil the requirements and cannot be compared to a dedicated digital radio networks. The 2.3 Billion Euros offer is based on an number of 700,000 users. Considering a maximum of 1,300,000 users in 2012, Vodafone estimates the costs at 3.3 Billion Euros. There is no distinction between the current private and the possible public users; subsidies cannot be excluded. Moreover, some services will be billed separately like SMS (e.g. status messages) which can result in high costs. Vodafone itself says that if a separated operator is to be founded, additional costs would be caused due to personnel costs and fewer synergy advantages. Thus, the GAN states that the well advertised 2.3 Billion Euros is not a solid base to rely on. The costs may be much higher. (cf. GAN02, p. 74 pp)

4.1.1 Recent Study prefers Tetrapol

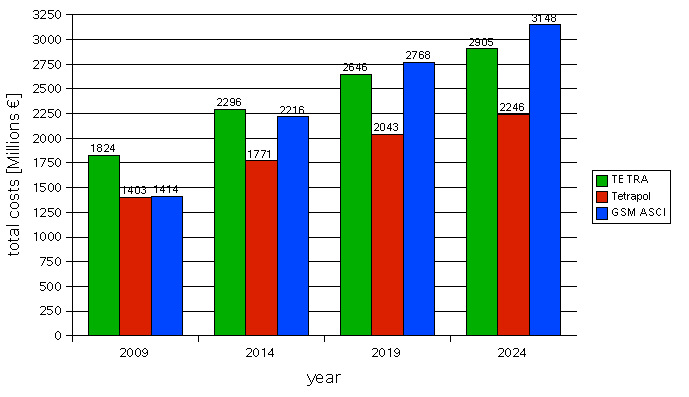

The most recent study by Torsten J. Gerpott and Andreas Walter (cf. GerpottWalter04) gives the most detailed and independent estimation available. This study calculated the costs for about 20 years from 2005 until 2024. Several factors are evaluated of which I choose the following:

- the coverage: there are several requirements and I will only show the data for the latest requirements made by ZED in October 2003 (cf. BMIPGBOS03, p. 9)

- the relationship between TETRA and Tetrapol base stations (there are fewer base station needed for the same coverage): The relationship 2:1 is taken (cf. BAKOMTetrapol01, p. 7)

- the variable demand of frequencies by the PSS in and the relationship between PSS and private users in the GSM network: I have chosen the realistic combination that considers the demand of frequencies with more costs

The basic numbers the study relies on are listed below:

| TETRA | Tetrapol | GSM ASCI | |

|---|---|---|---|

| number of (additional for GSM) base stations | 3,000 | 1,500 | 200 |

| cost per base stations including data connection | €267,000 | €294,000 | €200,000 |

| cost for backbone (GSM: extension) | €700,000,000 | €700,000,000 | €280,000,000 |

| number of employes for base stations amount of employes in 2005 number of employes in 2006 number of employes from 2007 on | 250 200 320 400 | 125 200 320 400 | 40 % of TETRA |

| salary per employe (increases 2.5 % per year) per year | €74,000 | €74,000 | €29,600 |

| material costs (increase 1 % per year) per year | €97,565,000 | €74,165,000 | €39,026,000 |

| training costs (increase 1.5 % per year) per year | €4,995,000 | €3,607,500 | €1,998,000 |

Considering the costs, mostly Tetrapol is the cheapest possibility. Tetrapol is always cheaper than TETRA since only half the base stations are required and the costs of one Tetra base stations are only 10 % lower than the costs of one Tetrapol base station. GSM ASCI causes the same costs in the beginning like Tetrapol since there is less investment in the beginning for GSM ASCI due the fact that fewer base stations are needed. But greater variable costs follow later. There could also occur additional costs for GSM licences in 2010 that can additionally increase the variable costs.

The end user devices costs were not calculated for each solution since they would not differ. The GSM end user devices cannot profit from the low costs of consumer devices since they must have additional ASCI features and especially a TETRA extension for the DMO that raises the costs.